Introducing IBOS

When it comes to choosing your banking network, there’s no better choice than IBOS. We offer a range of benefits both for banks looking to improve their offering both in-country, and internationally.

View our pitchbook

With a network of banks across the world, we make international banking easier. Find out how our advanced online platform is making global banking simpler and more efficient for our customers and their clients.

How it works

As an IBOS member, you get access to a wide range of global services and commercial banking organisations across our network. Find out more about the services and benefits offered by our member organisations.

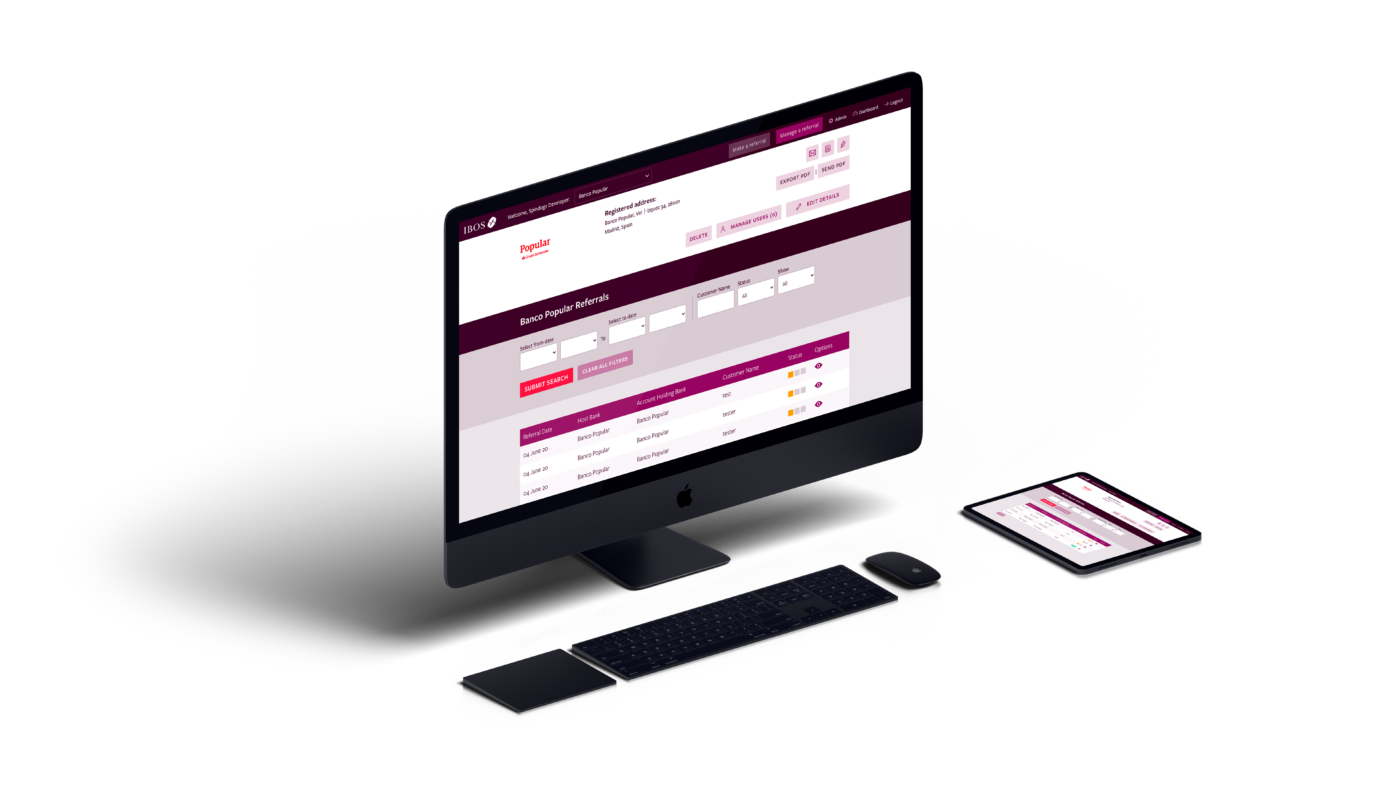

IBOS Portal

The IBOS portal provides a seamless banking experience for our international members. From managing referrals to creating broadcasts and analysing data, request a demo to see how the IBOS portal can enhance your efficiency.

Raiffeisen Albania

AustriaRaiffeisen Bank International Group (Austria)

BelgiumKBC Bank NV / CBC Bank

Bosnia and HerzegovinaRaiffeisen Bosnia and Herzegovina

BrazilBanco Santander (Brasil) SA

BulgariaUnited Bulgarian Bank AD

CanadaRoyal Bank of Canada

ChileSantander Chile

ColombiaBanco Santander (Colombia)

CroatiaPrivredna Banka Zagreb P.L.C.

CroatiaRaiffeisen Croatia

Czech RepublicCeskoslovenska obchodni banka, a. s

Czech RepublicRaiffeisen Czech Republic

DenmarkNykredit

FranceCIC (member of Credit Mutuel - Alliance Federale)

FranceKBC Bank NV France

GermanyIntesa Sanpaolo - Frankfurt

GermanySantander Consumer Bank AG

HungaryK&H Bank

HungaryRaiffeisen Hungary

IndiaAxis Bank

IrelandBank of Ireland

ItalyIntesa Sanpaolo S.p.A.

KosovoRaiffeisen Kosovo

MexicoSantander Mexico

NetherlandsRabobank

PeruBanco Santander (Peru)

PolandSantander Bank Polska S.A.

PortugalBanco Santander Totta SA

Raiffeisen Romania

SerbiaRaiffeisen Serbia

SlovakiaCSOB Slovakia

SlovakiaRaiffeisen Slovakia (Tatra Banka)

SloveniaIntesa Sanpaolo Bank Slovenia

SpainBanco Santander (Spain)

UkraineRaiffeisen Ukraine

United KingdomNatWest

United KingdomRoyal Bank of Scotland

United KingdomSantander UK plc

United StatesSantander Bank, N.A.

United StatesSilicon Valley Bank, , a division of First Citizens Bank & Trust

UruguaySantander Bank (Uruguay)