Which Central and South American Banks allow cross-border payments?

Working with corporate banks across Central and South America, at IBOS we are open at all hours. Our sweeping geographic presence, combined with our strong reputation, makes us a desirable alliance for a number of leading banks from all corners of the world.

Whether you’re refocusing on your bank’s core domestic market and looking for a global partner to help with your international business, or you need support providing effective and thorough cash management across multiple regions, becoming an IBOS member benefits both your organisation and your corporate clients.

| Central & South America Banks | Country | Group |

|---|---|---|

| Banco Santander (Brasil) SA | Brazil | Banco Santander (Spain) |

| Banco Santander (Peru) | Peru | Banco Santander (Spain) |

| Santander Bank (Uruguay) | Uruguay | Banco Santander (Spain) |

| Santander Chile | Chile | Banco Santander (Spain) |

| Santander Mexico | Mexico | Banco Santander (Spain) |

The IBOS Cross-border Banking Alliance

IBOS is an international banking alliance that provides connectivity for key corporates looking to expand beyond their borders. With some of the biggest commercial banks from across the globe as our members, we’re confident that we can offer effective and thorough cash management in regions where your local bank does not offer access.

Uniform, high-quality cross-border banking provided by all IBOS members

- Unified client onboarding and service processes make partnerships between IBOS banks seamless

- Dedicated multi-lingual teams in each bank can provide efficient support and assistance with local issues.

- Access to a wide network with clear processes, quality checks and escalation procedures in place to ensure issues can be resolved quickly and efficiently

Access to an international network of banks and affiliates

- Find the best partners internationally from a pool of nominated affiliates that other members work with

- IBOS offers banks access to the best service at the best price, anywhere in the world

- Greater opportunities for business deals through an expansive network in each country

- Save on the costs of international agreements by utilising the network of local IBOS members

If you would like to provide your clients with access to international banking services, get in touch. Our team can arrange a demonstration of our web portal, showing you what it would be like to join our growing network.

What are cross-border payments?

Cross-border financial transactions, where the payer and the recipient are based in different countries, can cover both retail and wholesale payment types, including remittances.

Cross-border payments can be made in many different ways with the most prevalent currently being e-money wallets and mobile payments along with more traditional methods such as Bank transfers and credit card payments.

The two main types of cross-border payments are:

- Wholesale cross-border payments: These are used by financial institutions on behalf of their customers or their own cross-border activities (such as borrowing and lending, foreign exchange, and the trading of equity and debt, derivatives, commodities and securities). Wholesale can also include large transactions generated by the import and export of goods and services or trading in financial markets, usually by Governments or large non-financial companies.

- Retail cross-border payments: These are typically person-to-person or person-to-business and sometimes business-to-business.

Why are cross-border payments important?

The world is seeing an increase in international mobility of goods and services, as well as people. The value of cross-border payments is estimated to increase with projections for 2027 possibly reaching $250 trillion (from $150 trillion in 2017).

Contributing factors to this projected growth include:

- diversification of supply chains

- asset management and global investment flows across borders

- e-commerce growth

- migrants sending money via international remittances

How do cross-border payments work?

Domestic payment systems are not usually connected with equivalent foreign systems, so the currency is not physically transferred overseas.

Banks which allow cross-border transactions provide accounts for their foreign counterparts which are then reciprocated by the counterpart, which enables those banks to make cross payments in foreign currencies.

Funds are not sent across borders; accounts are credited in one jurisdiction and debited the corresponding amount in the other. Other payment providers such as Fintechs and money transfer agents use this interbank network to provide payment services to businesses and individuals.

Types of cross-border payments

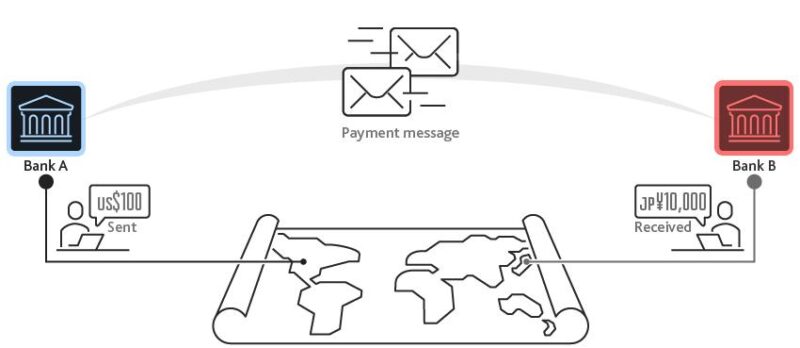

Figure 1: A simple cross-border payment using accounts held at each bank

A payment message sends an instruction to debit an account in Bank A and credit an account in Bank B.

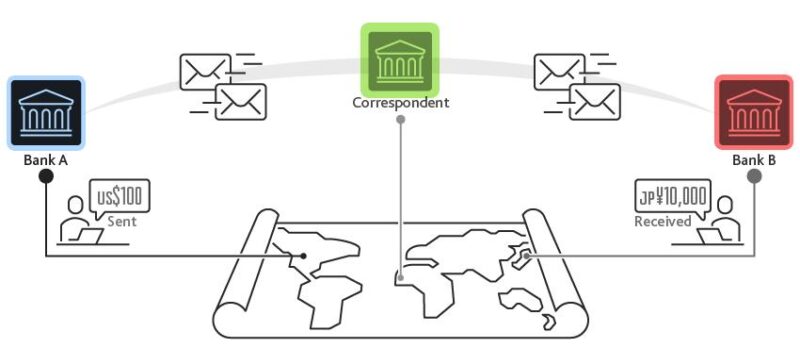

Figure 2: A cross-border payment using a correspondent bank

Bank A and Bank B do not have accounts with each other so they use a bank where they both hold accounts ie. the correspondent bank.

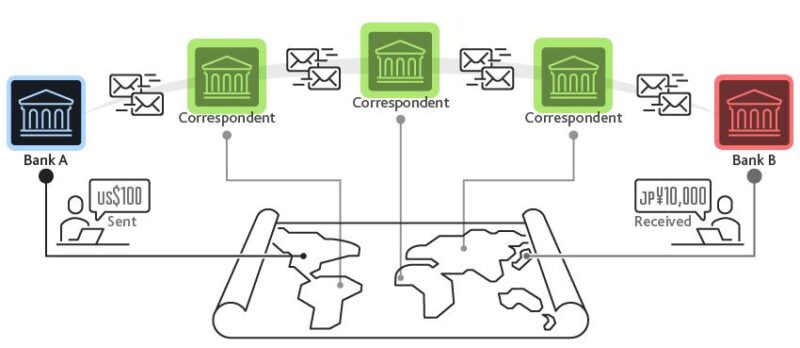

Figure 3: Cross-border payment using the correspondent-banking network

The less common the currency pair, the more correspondent banks will be required to make the payment, incurring costs and delays at each stage.

The main problems associated with cross-border payments

Cross-border payments are generally much more difficult and complex to achieve compared to making similar payments within a single country. In some instances they can take several days and can cost many times more than a standard domestic payment.

Fragmented and truncated data formats

Payment communications between international financial institutions consist of a wide range of data standards and formats. This makes it difficult to set up automated processes, causing delays processing costs.

Complex processing of compliance checks

A financial transaction may have to go through duplicate regulatory checks across regions to ensure each institution is not exposing themselves to illicit finance.

This complexity increases with the number of intermediaries in a chain and makes compliance checks costly to design, hampers automation and leads to delays or the rejection of payments.

Limited operating hours

In most countries, the settlement system’s operating hours are usually aligned to the normal business hours in that country. This causes delays and also means banks need to hold enough cash to cover the unknown costs of the eventual foreign exchange rate, which fluctuates during this time, driving up the overall cost of the transaction. This is known as trapped liquidity.

Legacy technology platforms

A significant proportion of older cross-border payment systems still rely on batch processing and have no real-time monitoring along with a low data processing capacity. This creates delays in settlement and trapped liquidity.

High funding costs

To improve settlement speed, banks provide funding in advance, often across multiple currencies, or to have access to foreign currency markets. This reduces the amount of capital that could be used to support other activities, which increases costs.

Long transaction chains

The issues detailed often make it costly for banks to have relationships in every jurisdiction. The correspondent banking model is used to reduce risk and cost but it also results in longer transaction chains, which in turn increases cost and delays.

Weak competition

Assessing costs is difficult for end users which in turn makes it difficult to gauge the competitiveness offered by different providers. These barriers can offer little incentive to moderate prices or invest in improving cross-border payment processing systems.